All Categories

Featured

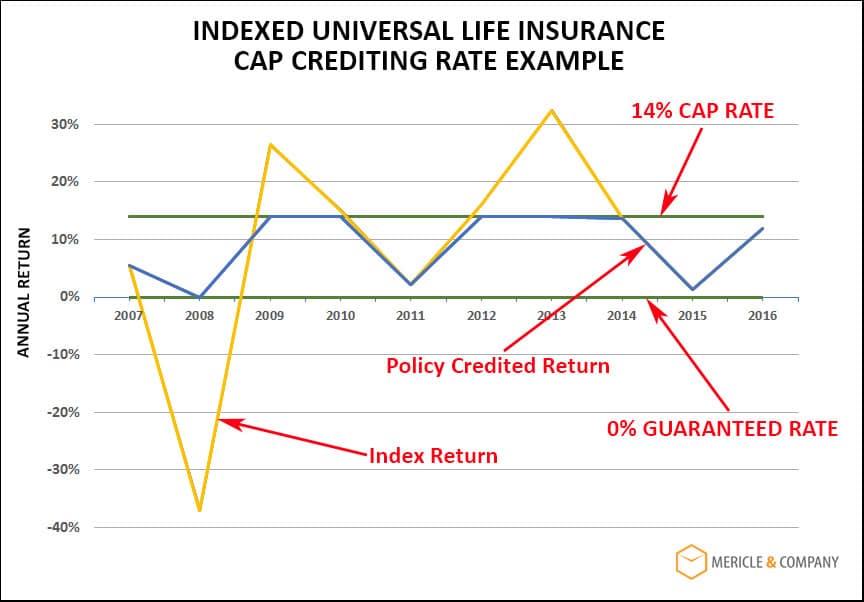

If you're mosting likely to make use of a small-cap index like the Russell 2000, you might wish to stop and consider why a good index fund company, like Vanguard, does not have any type of funds that follow it. The factor is because it's a poor index. In addition to that altering your entire policy from one index to an additional is barely what I would certainly call "rebalancing - index universal life vs roth ira." Money value life insurance policy isn't an attractive asset course.

I haven't even attended to the straw male here yet, and that is the reality that it is relatively unusual that you actually have to pay either taxes or substantial commissions to rebalance anyway. Many smart financiers rebalance as much as possible in their tax-protected accounts.

Term Vs Universal Life Insurance Which Is Better

Decumulators can do it by withdrawing from asset courses that have actually done well. And certainly, nobody ought to be purchasing loaded shared funds, ever. Well, I hope blog posts like these aid you to translucent the sales tactics usually utilized by "financial experts." It's really also poor that IULs don't function.

Latest Posts

Equity Indexed Universal Life

Indexation Insurance

Universal Retirement Protection